The Payroll Center Has the Following Sections Except

These transactions include employer-related payroll expenses and employee deductions. What is the purpose of form 490.

Solved Federal Taxes Not Deducted Correctly

Payroll Register Review of the Key Control document.

. This payroll accounting 2013 chapter 6 solutions after getting deal. Although not shown here Feb 2019 and later releases allow you to pick a beginning and ending date if you wish to analyze a subset of a year. Please Note the Following.

The 2020 Payroll Processing Calendar has been updated to reflect the latest payroll journal posting dates. Calculate Period and YTD Amounts. It is the repository of all information collected from the systems and functions discussed in this section as needed to process payroll and is the supplier of record keeping information and report information.

Payroll also refers to the total amount of money employer pays to the employees. The calculation of payroll has no concern about employee time data The followings are TRUE statements in regards with Personnel Cost Planning except1. Problem 23MCQ from Chapter 6.

Payroll Transaction Detail report c. The following is the new Warning message that users will see upon logging on to Insight RPCT SALL and WebSETS. Review and Create Paychecks.

Summarize the amount of unemployment tax paid and due by the company. Manages payroll and tax information. Select year in From generally the current year Click the magnifying glass button next to Projections.

Payroll Accounting 2013 Chapter 6 Solutions Computer Accounting with QuickBooks 2013 15th Edition Edit edition. Pay Scheduled Liabilities D. The Payroll Center has the following sections exceptA.

The UCPath Center has provided representative timing for when locations will receive labor ledger data which allows us to provide more accurate anticipated dates for posting to the General Ledger and availability in MyReports. Government information system which includes 1 this computer 2 this computer network 3 all computers connected to this network and 4 all devices and storage media attached to this. Payroll center has the following sections except.

Choose Payroll Center. The following are payroll liabilities except. Page 360 The correct answer is.

Payroll journal entries are used to record all payroll transactions of a business. 2341 The payroll processing system comprises the central processing system for calculating payroll. Is used to preview the.

After the payroll is processed data from both the NFC and PPC is sent via electronic files to NOAA Production Control for input into the Labor Cost System a subsidiary system of the Commerce Business System CBS. In addition the are several recommended reports highlighted to run andor review prior to payroll opening to ensure accuracy. Locate then click the payroll in the Recent Payrolls section.

You are accessing a US. When an employee does not have the TA Employee Interface role ie. Choose the paycheck you need and click the Delete button.

However depending on your processing time the debit from your bank for taxes and direct deposit might not be stopped. KEY Internal Controls and Procedures C. Developing organization pay policy including flexible benefits leave encashment policy etc.

The Payroll Center has the following section except. Payroll is a list of employees who get paid by the company. Interim Payroll Processes During COVID-19 I-9 Collection During COVID-19 Time Approval Deadlines.

QUESTION 50 The Enter Payroll Information window is used to select the employees to be paid at the current pay date. Payroll Liability Balances report Correct d. Interface policy he or she will not display in any section except the Employees Denied Access to Payroll Interface and Employees Not Setup for.

Go to Advanced Payroll v2 Reports Payroll Projections. Payroll Item List Question 3 Correct 250 points out of 250 Flag question Question text The report that displays the payroll taxes owed and unpaid for a specified period of time is the Select one. The position automatically inherits the tasks and characteristics assigned to the job The followings are TRUE statements in regards with Payroll submodule except3.

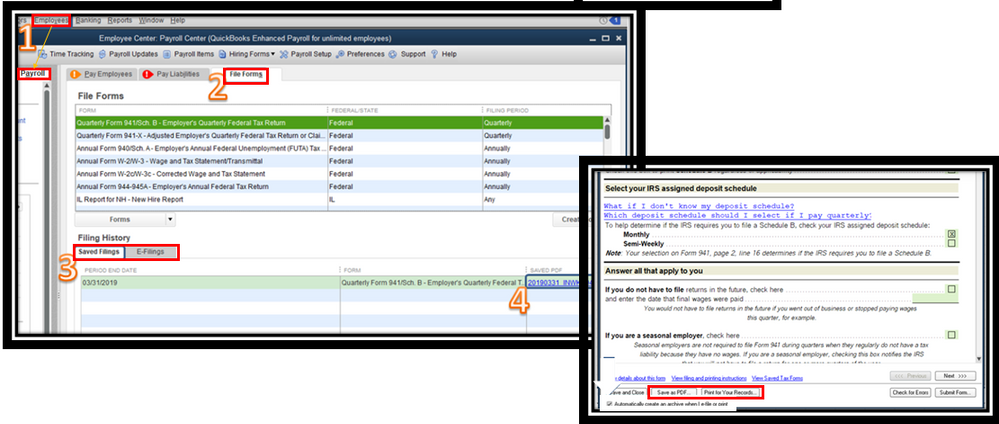

The Payroll Center has the following sections. As a business function it involves. The Payroll Center has the following sections except.

File tax forms Pay scheduled liabilities pay employees. Select OK to confirm the changes. Click the Pay Employees tab.

Defining payslip components like basic variable pay HRA and LTA. QUESTION 49 The Pay Employees feature has each of the following windows except Enter Payroll Information. Personnel Center PPC in Topeka Kansas processes the payroll for the NOAA Officer Corps NOAA Corps.

Pay Scheduled Liabilities D.

Where Can We Find The 941 Report That Qb Filed

Quickbooks Desktop 2021 Improved Functionality With Connected Services Quickbooks

No comments for "The Payroll Center Has the Following Sections Except"

Post a Comment